Inflation diaries: aggregate burrito spend, treatflation, and waging a war on wages

Is the wage-price spiral like for real?

Today I set out to answer a critical question: does inflation matter to me, a 28-year-old, freewheeling yuppie who likes Campari, french fries, and independent film?

I first looked at some classic bars and restaurants my friends and I have frequented in recent years. Using the highly precise methodology of scrolling through the “Menus” tab of a restaurant on Google Maps, I discovered that even my beloved 2AM hot dog and fries at Red Hot Ranch increased from $3.52 to $4.97 in the last five years. That’s a 41% increase in price!

Now let’s consider the idea that “inflation is cooling.” In June, the basket of items in the BLS’ consumer price index rose only 3% year-over-year. There’s some buzz online this week suggesting that inflation is no longer the bogeyman it once was; the labor market has weakened as the unemployment rate has risen; and perhaps it may (finally!) be time to lower interest rates. What this news doesn’t capture is that many goods are still quite expensive compared with their pre-pandemic equivalent.

The long-term impacts of inflation continue to hit wide-reaching sectors of the economy, including, most tragically, a great burrito spot here in San Francisco. This month, the owner of “Top 5 Burrito Spot” Caliente Bistro Kitchen declared his business may go bankrupt this summer due to dramatic year-over-year price increases in meat and produce. Beef that was once $3.80 per pound is now $5.15. A 30-lb. case of Roma tomatoes that was $10 just over a year ago is now $35.

It’s normal for things to get more expensive; but for businesses and consumers to internalize it without pain, then wages and consumption must increase as well. I’m not convinced that this has happened universally. Essential stuff like groceries got really expensive, really fast right after the pandemic but paychecks never seem to grow as quickly. (And yet it is still my duty to order a tasty steak burrito.)

This is 10 years of the BLS’ Consumer Price Index, which is the cost of a basket of necessary, commonly-purchased goods in U.S. cities. You could ski down this slope!

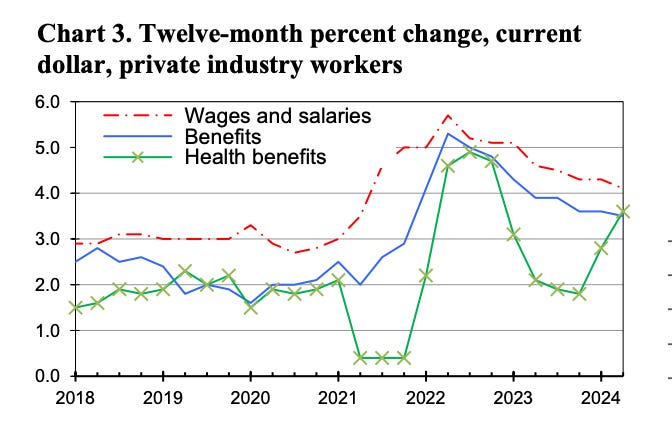

For a lot of young people like myself, even those of us in traditional white collar jobs, salary increases have barely if at all kept up with inflation. While 2021 saw wage growth as the economy recovered from the pandemic, wages don’t seem to be rising as quickly as they once did, according to the BLS’ Employment Cost Index. So what does a “cooling” economy with high prices mean for you and me?

Source: BLS Employment Cost Index - June 2024, page 2

Debt-burdened young people like myself face an environment that doesn’t feel catered to us. The rising cost of housing (where inflation is really felt) eats a chunk of our paychecks every month. The weakening labor market (in addition to my own concerns about the jobs market) could really pose a threat to our livelihoods in the future, especially given that, by definition, we have less experience, less money, and fewer professional connections than older people. Not to mention, in the last 50 years, wages have become disconnected from productivity. Looking ahead, I am not sure how optimistic this makes me about the future, especially given the market hype around artificial intelligence. Even if we obtain the “limitless productivity” that artificial intelligence zealots are preaching, if productivity is no longer linked to wages, the impacts regular people feel will be tiny.

Anyways, back to the “me-search.” I have a good job and a healthy savings account – so is inflation really a problem for me? I love Refinery29’s Money Diaries and thought I might employ a similar investigation into my own finances. Maybe my spending has gotten really high after all?

If you don’t know me: I live in San Francisco and work in economic analysis. A few other, potentially important facts about me:

I am 28 years old.

I have a Master’s Degree.

I work one full-time, six-figure job. I have had several full-time jobs before, in addition to various Teaching Assistantships and Research Assistantships.

Now for a very unscientific exploration of my credit card data. Please note this is data is obviously imperfect: some expenses are probably miscategorized; occasionally I pay for an expensive dinner on my credit card and my friends will Venmo me (the full cost of the party’s dinner would be reflected here); and I have an affinity for cash-only dive bars (which are by definition excluded from this data). Also perhaps worth noting, while I give a good amount of thought to monthly retirement and savings contributions, this is (embarrassingly) my first examination of my credit card spending.

First I gathered my estimated food and drink spend and compared it in six-month increments to years past.

I suspect that, as is likely the case with most young people, months I spend with family (January 2023 with my family and July 2024 with my boyfriend’s family) dramatically reduce food and beverage consumption costs. I am surprised by how, even given that observation, my spending is still pretty scattershot. I decided to break down the categories a bit further – a sampling of this is depicted below – and I was still surprised by the variety (and amount spent).

If I’m noticing anything here it’s that my spending is “experience”-driven (like a lot of people my age) and varies pretty significantly, making any real estimate of spending and inflation kind of impossible. One month I am buying a vacation in France and another I am living at home, eating the rice and beans in my parents’ cabinets. This seems typical for a young person, who experiences “lifestyle creep” as a mix of growing up and retaining some thrifty habits from college days.

If I wanted to bring my costs down, given that my food and drink spend oscillates the most, I could probably achieve a lot with the conscious decision to avoid $16 burritos after long work days (the monthly aggregate cost of which may or may not exceed $60). But that brings me to an interesting point: if I’m lucky enough to be able to contribute enough to the essentials, how concerned should I be about my erratic spending on my little luxuries?

For many Coastal Zillennials like myself, “treat culture” reigns supreme in the face of larger economic anxieties. I have to work very hard, often past 6pm, to be able to pay rent and my health insurance premiums. While you could argue that I’ve “earned” the treats I purchase, I think that just by the nature of living in the same time period of the espresso tonic justifies its purchase. I am just an animal walking this Earth, making the best of what is available to me. Self-discipline may be a virtue, but the simple enjoyment of life strikes me as a more fundamental value.

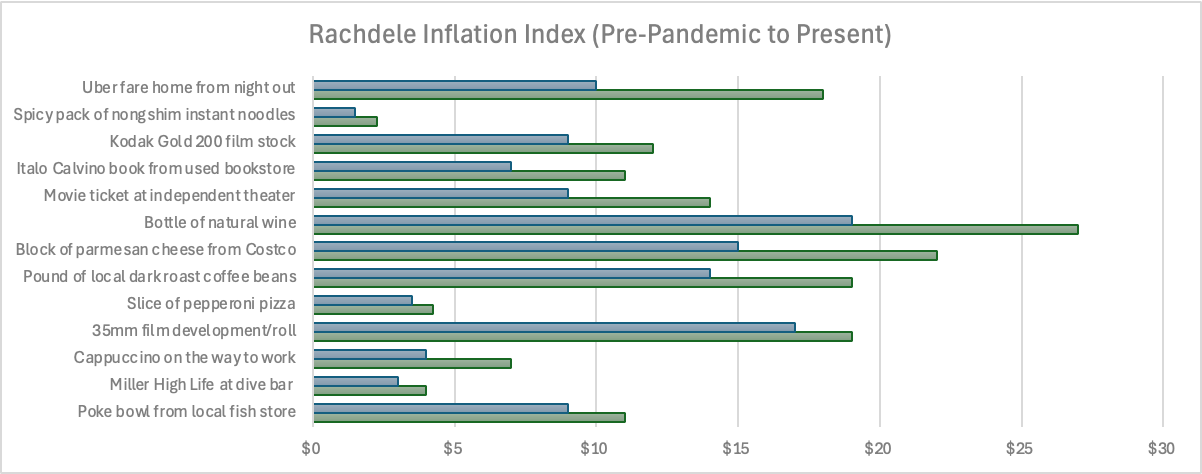

So in addition to insidious rent increases, “treatflation” also may inhibit my enjoyment of life as my spending power decreases. Below I created my bread basket in an attempt to gauge price increases (purely vibes-based) because CPI mainly measures necessities like bread and rice. The costs of fun, important things like concerts seem to have skyrocketed independently — a trend that isn’t encapsulated in conventional CPI at all. My “fun” expenses seem to have a similar fate.

However silly of a list it may be, reflecting on these price increases gives me a much clearer understanding of inflation than any of the CPI statistics I scroll past on my phone. It’s also a good reminder for me to limit excess spending in the wake of inflation (I could probably swap out my coffee beans for a less-expensive brand). But even though my spending is pretty all over the place and the things I like are surely getting more expensive, spending a bit on things I like and especially social spending (like dim sum with good friends) is non-negotiable.

I’d rather my life be measured in Campari sodas than insurance premiums. Unless the price of something crosses a severe threshold (the sort of which seems to have happened with McDonald’s), I think a lot of young people like myself naturally and rightly prioritize what makes us happiest (maybe to Zillennials, treats are inelastic goods?). Once my monthly fixed costs are paid for and lamented, what else is my money for?

Special thanks to Quinn Underriner for his sharp and critical advice, and to firms like ExxonMobil and Kraft Heinz, without whom I might never have believed in greedflation.

Great post - i liked this a lot

Self-discipline may be a virtue, but the simple enjoyment of life strikes me as a more fundamental value.

I need to participate in treat culture at your $11 poke spot